Filing and Paying Your Taxes

How to Read Your Tax Return

Think of your federal tax return (which is called the 1040) like the trunk of a tree. All the other forms branch out from there.

Updated 1 week ago

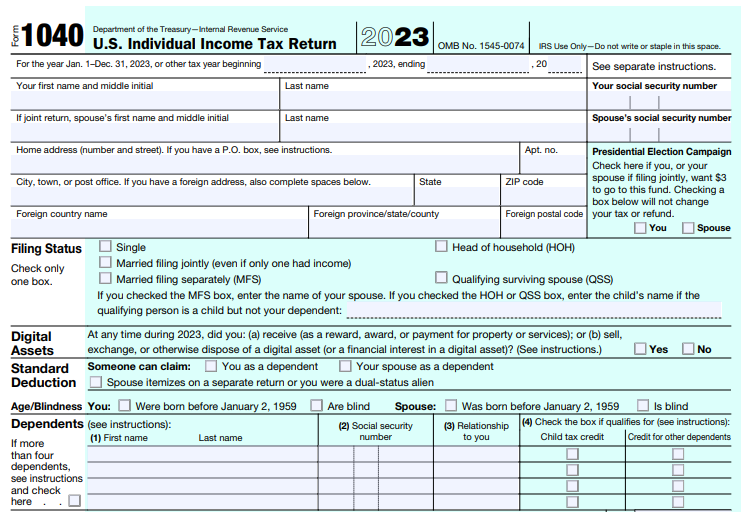

Here she is, the one, the only, the 1040. You've got personal income taxes? You're getting this form. For such an important document, something hundreds of millions of people receive each year, the 1040 is very poorly formatted, confusing to follow, and filled with tiny numbers and abbreviations that lack meaningful context. Fear not, we're here to help make sense of it all.

Top of the Form (base of the trunk, if we're still with our metaphor)

Let's take the return step-by-step, starting with demographic information:

Think of the above as the "Who are you?" section. Here, the IRS wants to know if you're single or married, if you have kids or other other people in your life you support, how old you are, and where you are. All these things potentially impact your taxes.

And note the 2023 at the top! Changes are made to the 1040 each and every year, both large and small. But the function of the form remains constant. It is always the “trunk” of the tax return.

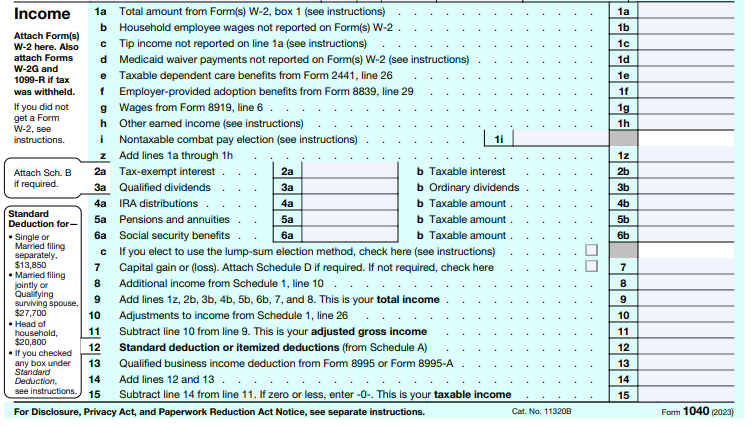

Middle Bits (of the first page)

This section summarizes the money you made, how it was made, and what personal expenses you might have that reduce how much of that income is taxable:

Note on the left how different filing statuses have different standard deductions. This is the IRS's way of accounting for the fact that everyone has personal expenses, without them having to go through millions of shoeboxes of receipts. Example: Your income from W-2s and dividends and stocks gets added up to $100,000, and then $13,850 is subtracted from that amount (if you're single in 2023), which leaves you with $86,150 in taxable income.

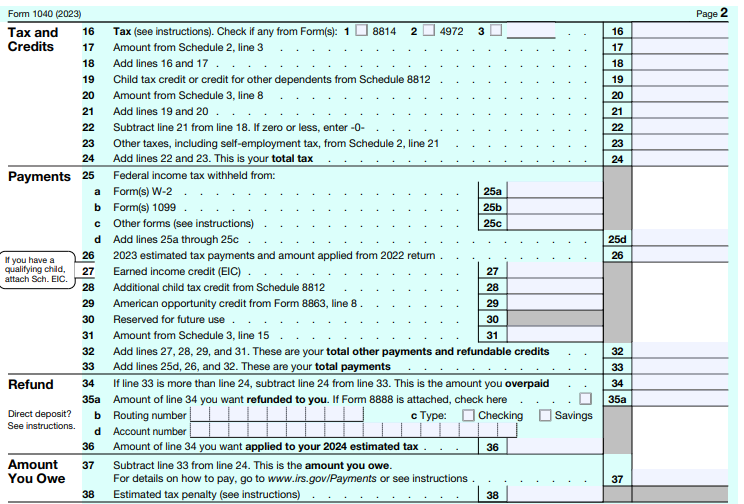

Second Page (it's starting to get branchy up here)

Think of this page of the tax return as a long-winded way of saying how much you owe (or will get back from) the IRS:

General questions the IRS is thinking about here are: “Do you have kids, or pay for college, or do other things we should keep in mind when calculating how much you owe in taxes?” And, importantly, this is also where they're asking, “Have you already paid us anything this year?”

This is also where you can see that there's not only income tax (line 16) but self-employment tax (line 21) as well. It's easy to forget when you're busy freelancing throughout the year, but no one is taking withholdings out of your freelance income, meaning you're responsible for paying income taxes and self-employment taxes. If you haven't made quarterly estimated payments throughout the year, you'll settle up for the full tax bill when you file the tax return.

All the Branches (all those "schedules" and other forms that come after the 1040)

The schedules, worksheets, and other forms break down how the numbers on the 1040 are calculated--for example, the math behind a tax credit or a breakdown of your freelance business expenses. Your tax return might have dozens of pages of forms and schedules, or it might only have a few. The important thing to know is that all those forms and schedules, no matter how dense or minute, are ultimately represented on the 1040.

Still stumped when it comes to reading between the lines of your tax return? You can always schedule a consultation for a walk-through with an advisor.