What is the difference between “taking the standard deduction” and “itemizing”?

Filing and Paying Your Taxes

What is the difference between “taking the standard deduction” and “itemizing”?

People throw words like deduction or itemizing around a lot, but they don't always use the terms correctly. We'll explain what's going on and how it impacts you.

Updated 1 week ago

Taxes can be confusing, and there are a ton of terms that are really specific to the weirdness of the US system. One of the terms that a lot of our clients find confusing is "itemizing." What the heck does that mean? And why do bureaucrats always turn nouns into verbs?

We can't explain the nouns into verbs conundrum. But we can definitely help with defining the tax terminology.

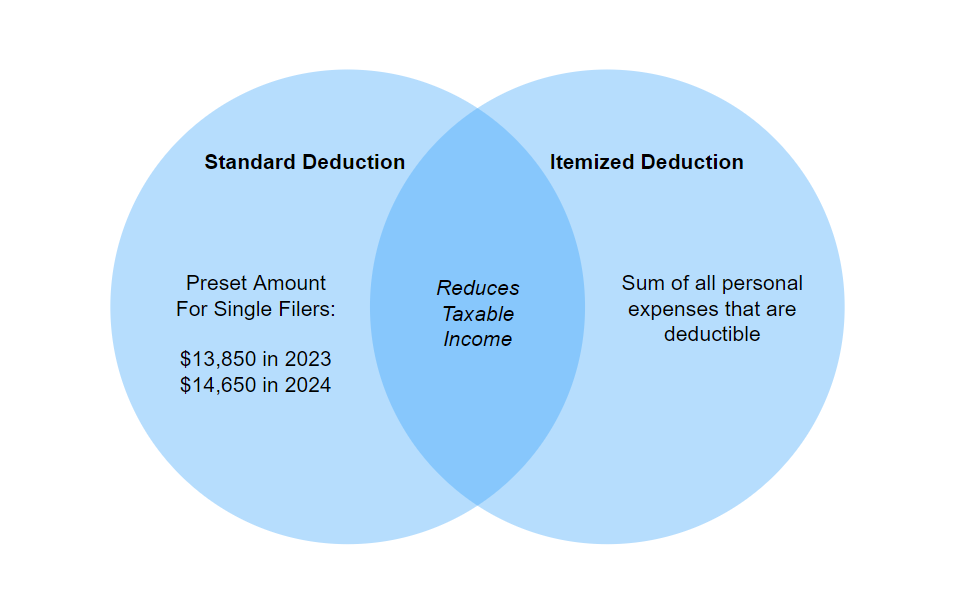

The basic concept to start with is that the government has created a way to acknowledge in our taxes that some chunk of our income goes toward basic life stuff like healthcare and housing, for instance. And they're giving us a break for some of that by allotting a chunk of our income that we don't have to pay taxes on at all. For many of us, that takes the form of the "Standard Deduction." This number changes from year to year based on the latest tax laws, but for 2025, it's $15,000 for single filers. That amount is different if you have a different filing status (married filing jointly, head of household, or qualifying widower).

Itemizing, on the other hand, is when you list out your deductible personal expenses (not your business expenses). This usually includes things like medical expenses, mortgage interest payments, and charitable donations, for example. It is far less common to need to itemize these days, because the standard deduction has increased a lot in recent years. But we'll ask you questions to make sure that we're setting you up in the best position for the year during your tax appointment.