Filing and Paying Your Taxes

How do I send a 1099?

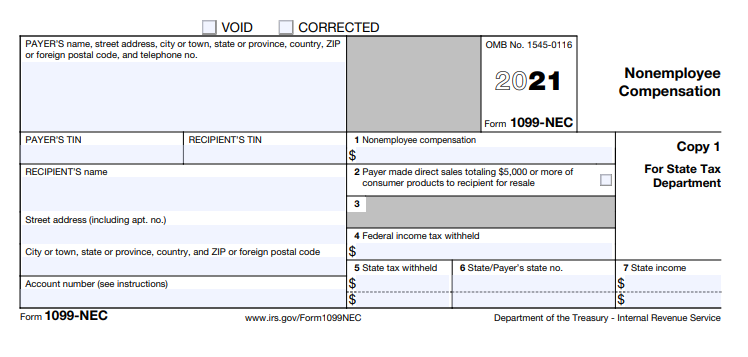

In the past, if you hired other freelancers or contractors to help with your business, you had to fill out a 1099-MISC. Starting in 2021, you'll generally file a 1099-NEC instead.

Updated 1 week ago

If you earn freelance income and you paid another freelancer $600 (or more) or over the course of the year to help you with your business, you probably need to send them a 1099-NEC. Basically, you’re sending a record to that person, and to the IRS, of how much you paid them.

You have multiple options for filing these:

You can use the IRS's online Taxpayer Portal to file

You can use services like efilemyforms.com or track1099.com

1099s are due January 31 for the preceding year, so be sure to take care of them in a timely manner to avoid any potential penalties!

Things You Need to Fill Out a 1099-NEC For Someone You Paid

The easiest thing to do is ask the people you paid to send you a completed form W-9. This form will include all the information you need from them.

Information needed for the person you paid (the "recipient" or "payee"):

Name (or business name)

Address

SSN (or EIN if they have one)

Information needed for you (the "payer"):

Name (or business name)

Address

SSN (or EIN)

When you’re filling out our website, you can include the folks you sent 1099-NECs to under “People You Paid” on the SELF EMPLOYED tab. Be sure to total everyone you sent a 1099 to, as well as anyone you paid under $600 (you just don't have to issue those people a 1099).