Why are you asking me about merchandise or inventory? And how do I fill that section out?

Income & Expenses

Why are you asking me about merchandise or inventory? And how do I fill that section out?

"Cost of goods sold" gives us a way to push large expenses forward to future years, and this can be really handy for people who sell merch and other goods they have to manufacture. We'll help you figure out if this applies to you.

Last updated on 04 Nov, 2025

Why are you asking about merchandise or inventory, and does this apply to me?

There's that old saying, "it costs money to make money," and that's particularly true for people who sell things they make themselves or get help to manufacture.

If you're someone who sells your own goods, such as jewelry, furniture, craft items, stickers, t-shirts, and other things that might be for sale on sites like Etsy or Amazon Handmade, then you likely have pretty significant costs to make the things you sell. Those costs could be for raw materials (precious gems or stones, wood, metal, fabric, wool, etc.) or they could be the cost of having others manufacture things for you (printers, merch companies, etc.).

Sometimes, when you make a large batch of product, you may not sell it right away. The reason we're asking about merchandise and inventory is to figure out if it might be useful to push some of the costs of making your products into the future, so that when the income comes in you have some expenses to count against it. Your tax preparer can walk you through the nuances of cost of goods sold, but if you spend a lot of money to make products and don't always sell the products within the same year you made them, then fill out the inventory section of the SELF EMPLOYED tab ahead of your appointment.

I'm a visual artist/filmmaker/ musician/writer. I spend a bunch of money to make my work, and it doesn't sell right away. Does inventory apply to me?

Generally speaking, inventory is not going to apply to folks like visual artists, filmmakers, or musicians, even though you likely spend a ton of money and effort making your creative work and don't always get paid for it right away.

Why? The short answer is that inventory is most likely to apply to artists who are operating more like manufacturers: people who make multiples of the same product and have high production costs to make those products.

We can still take the costs associated with making your visual art/film/music, we just can't use this particular method to push those costs forward to a future year.

There are some exceptions, such as visual artists who also use their work on things like stickers they sell online, or bands that produce merch to sell on tours. But in both cases we would only focus on the merch when we ask about inventory.

Okay, so I know inventory applies to me. How do I fill out your website for my tax appointment?

We need you to figure out what you paid to other people or companies to make each product/item that you sell (direct costs). We can't take things like your own labor and time (indirect costs).

Let's say, for example, that you're an illustrator who just started selling stickers, prints, and greeting cards featuring your work. You sell those things on Etsy, as well as through local retailers.

Here's how you would fill out our website when we ask about merchandise/inventory:

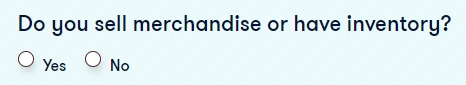

Answer "yes" to this question.

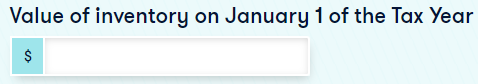

In this example, you just started selling these items, so your answer here is 0 (zero) since you didn't have any products when the year started.

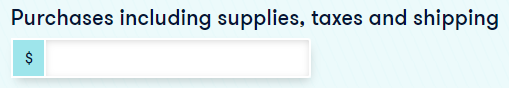

Let's say these were your costs:

Merch company that made 200 stickers for you (total cost = $300, includes taxes and shipping)

Printing company that made 50 high-quality prints (total cost = $500, includes taxes and shipping)

Printer who made 500 greeting cards and custom envelopes (total = $700, includes taxes and shipping)

Packaging company that made 100 boxes for you to put sets of 5 greeting cards and envelopes into (total = $200, includes taxes and shipping)

So you would add all those costs up and put $1700 in the box above.

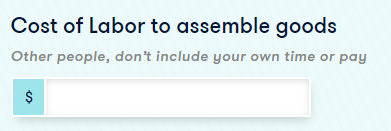

We can't count the labor or time you put into making your products. But if you paid someone else for help, we can take that expense.

In this case, let's say you paid a friend $300 to come for a day and help you assemble the greeting card sets. So you would put $300 in the box above.

This one involves a bit more math, but we've already got a lot of the information we need.

First we want to understand how much each product costs:

The 200 stickers cost you $300 to make, so they cost you $1.50 each.

The 50 high-quality prints cost you $500 to make, so they cost you $10.00 each.

The 100 greeting card sets cost you $1200 to make (the cost of the cards and envelopes, plus the boxes, plus your friend's help), so they cost you $12.00 each.

Now that you know how much each thing cost, you just need to figure out how much you have left of each. Here's an example:

You have 100 stickers left (costing $1.50 each), so the value of that inventory is $150

You have 30 high-quality prints left (costing $10.00 each), so the value of that inventory is $300

You have 25 greeting card sets left (costing $12.00 each), so the value of that inventory is $300

Adding those amounts up, you would put $750 in the box above.

NOTE: We never list how much you sell the products for here, only the actual cost to you to make each product.

We know it can seem tedious to figure this out, but it's really important for you to know how much it costs to make each product, not just for tax purposes, but also when it comes to figuring out pricing for customers. So it's worth taking the time to do this to help your business in general.

Need some help figuring this out? Reach out to info@brasstaxes.com to schedule a consultation.