Additional Common Questions

What percentage of my income do I pay in taxes?

While it is true that “the more you earn, the more you pay,” and it is possible that you’ll pay a higher percentage of your income taxes if you make more money, like most things related to the IRS, the story isn't so simple…

Last updated on 13 Nov, 2025

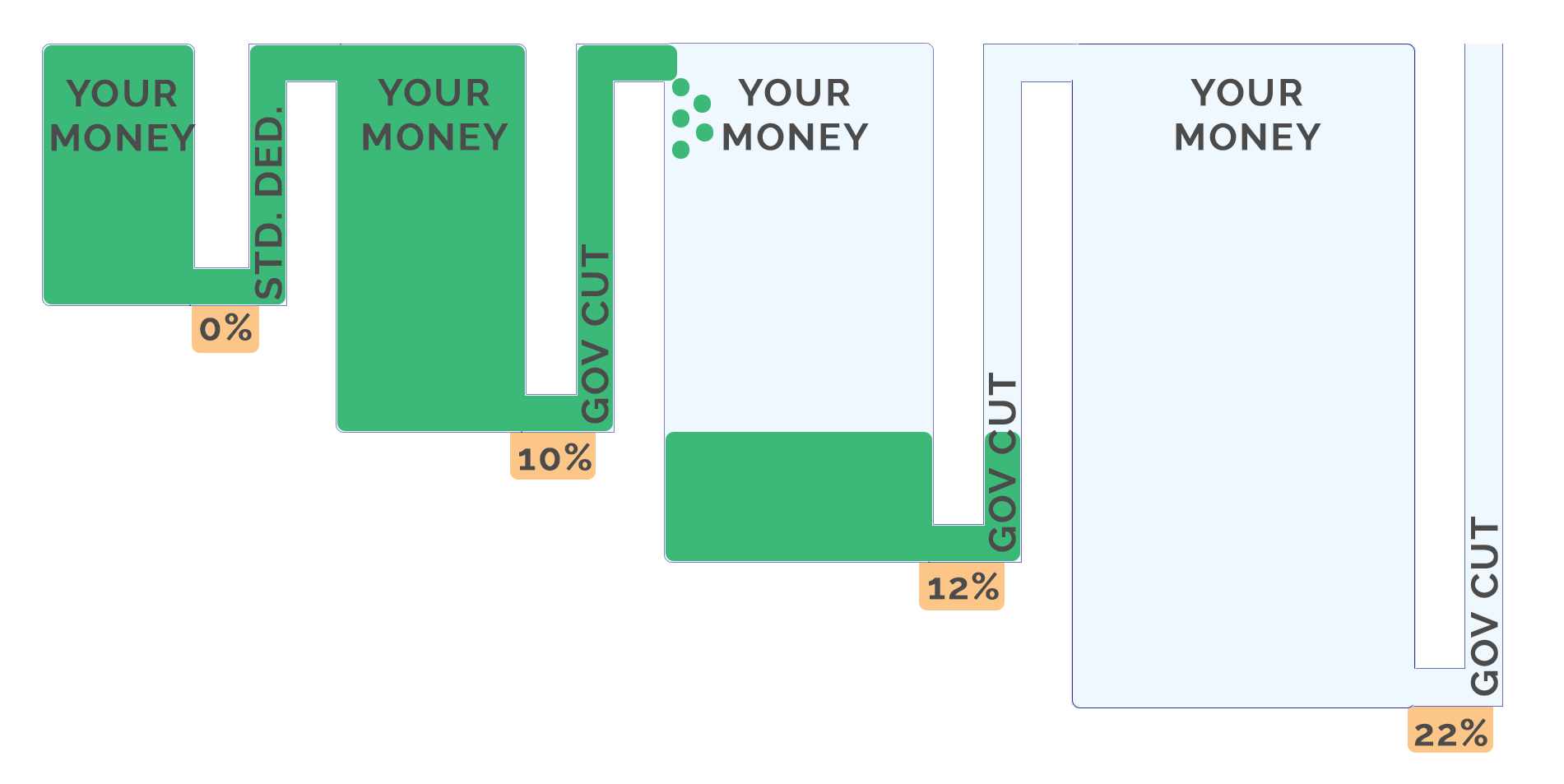

The US federal income tax system is a progressive tax system. This means that the higher your income gets, the more you’ll pay on some portion of that higher income. But that higher tax rate doesn’t apply equally to all of your income.

For instance, with your 2022 taxes, the first $12,950 of income that you earn (if you’re filing as a single person), won’t be taxed because of the standard deduction. Essentially the standard deduction removes that chunk of money from your taxable income.

The next $9,950 of your income will only be taxed at 10%.

Then if you make more, the money from between $9,951-$40,525 will be taxed at 12%, and so on following the chart.

There is a common misconception that when you bump into a new “tax bracket” that all of your income is taxed at that higher rate. That isn’t actually true. Only those dollars of income within the higher “bracket'' are taxed at the higher rate.

2023 Federal Income Tax Bracket for Single Filers

Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

10% | $0 to $11,000 | 10% of taxable income |

12% | $11,001 to $44,725 | $1,000 plus 12% of the amount over $11,001 |

22% | $44,726 to $95,375 | $5,047 plus 22% of the amount ove9r $44,726 |

24% | $95,376 to $182,100 | $16,189 plus 24% of the amount over $95,375 |

32% | $182,101 to $231,250 | $37,003 plus 32% of the amount over $182,101 |

35% | $231,251 to $578,125 | $52,730 plus 35% of the amount over $209,425 |

37% | $578,126 or more | $174,136 plus 37% of the amount over $578,126 |

Here’s an example that lays it out (keep in mind that the numbers below are only a ballpark and don’t take any specifics into account that could change the total, so they may not apply in your circumstances):

Say you’re an unmarried person who earns all your money through a W2 job and you make $72,000 in 2023:

Right away, $13,850 will be removed from the taxable income because of the standard deduction, leaving $58,150 in income.

The first $11,000 of that will be taxed at 10%, adding $1,000 to your (hypothetical) income tax bill.

The next $11,001-44,725 will be taxed at 12%, adding $4,047 to the running total.

Then, the final portion, or the income between $44,726-58,150 will be taxed at 22%, adding $2,953 to the running total.

Adding up those totals ($1,000+$4,047+$2,953) Leaves us with $8,000 as the approximate total, prior to any other adjustments in the tax return, of which there could be many!

If you do the math, you’ll see that $8,000 is only about 11% of the total income ($72,000). That 11% is what’s called the effective tax rate, and it’s far below the 22% paid on that last chunk of income.

But for those of us who are self-employed, you’ve got to also keep self employment tax in mind. It comes in at around 15% paid on your profit for the year (income minus expenses), but again, as with all IRS topics, it’s not so simple as there are some additional deductions available for freelancers.

Don’t understand something you’ve read above or want to ask more questions? Ask your prepare to explain this concept in more detail during your appointment. We can also let you know your effective tax rate based on your unique situation. Create your account on BrassTaxes.com to book an appointment!