Additional Common Questions

Do I have to pay taxes when I receive unemployment?

Generally, yes, you will pay federal taxes on any unemployment you receive. Depending on where you live, you may owe state taxes as well.

Last updated on 13 Nov, 2025

At the Federal Level

We know it's a surprise to many, but at the federal level, unemployment benefits are considered part of your income, along with wages, salaries, bonuses, investment gains, etc.

If you opted to have taxes withheld on your unemployment benefits, you might be wondering why you may still owe taxes on that income. As with many things related to taxes, it depends on a lot of factors, but in many cases the amount that is withheld just doesn't cover the full amount you owe, especially if you had other forms of income in the year you collected unemployment.

In general, it's usually worth having them withhold taxes for you.

State Shenanigans

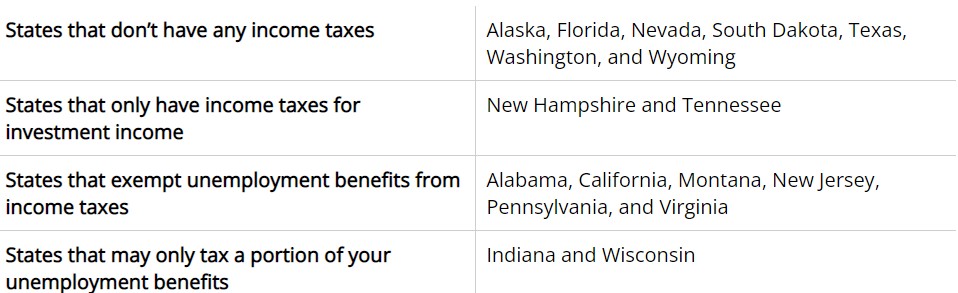

At the state level, the situation is a little more complicated...

New York, for example, taxes unemployment (and you can have state withholdings taken out of your benefits, too, though they may not completely cover your liability here either). California, on the other hand, considers unemployment to be untaxed income.

There are 17 states that don't tax unemployment: