You and Your Business

How to File Your Beneficial Ownership Information Report (BOI)

Starting January 1, 2024, there is a new federal law that requires companies (including LLCs) to file a Beneficial Ownership Information Report. It's free and you only have to do it once for each company (assuming the address of your biz doesn't change), but the fines are high if you miss it, so don't forget to do this.

Last updated on 21 Oct, 2025

In 2023, the federal government passed the Corporate Transparency Act, a law specifically aimed at increasing transparency around who owns LLCs, though it impacts other business entities as well.

What's important for you to know is that starting on Jan. 1, 2024, any company based in the US (including LLCs), or any foreign company that registers to do business in the US, that has filed with a secretary of state or similar office, must fill out a Beneficial Ownership Information Report (BOI), unless they qualify for an exemption. Exemptions only apply to large companies with 20 employees and $5,000,000+ in gross receipts, publicly traded companies, and specific regulated industries (you can see a complete list of exempt business types here.

Deadlines

If you registered your business before January 1, 2024, you have until January 1, 2025, to file your BOI report.

If you register a new business in 2024, you have 90 calendar days to file after receiving notice that your registration is complete.

If you register a new business on or after January 1, 2025, you will have 30 calendar days to file after receiving notice that your registration is complete.

NOTE: If you change the address for your business entity, or your name, you'll need to file an updated BOI report. Otherwise, it's a one-time filing.

How to File Your Initial Report for US-Based Business Entities

Thankfully this process is free and easy. Here are step by step instructions (note: this is general guidance and these instructions may not apply to every situation, please get in touch if you have questions about your specific situation):

Step 1

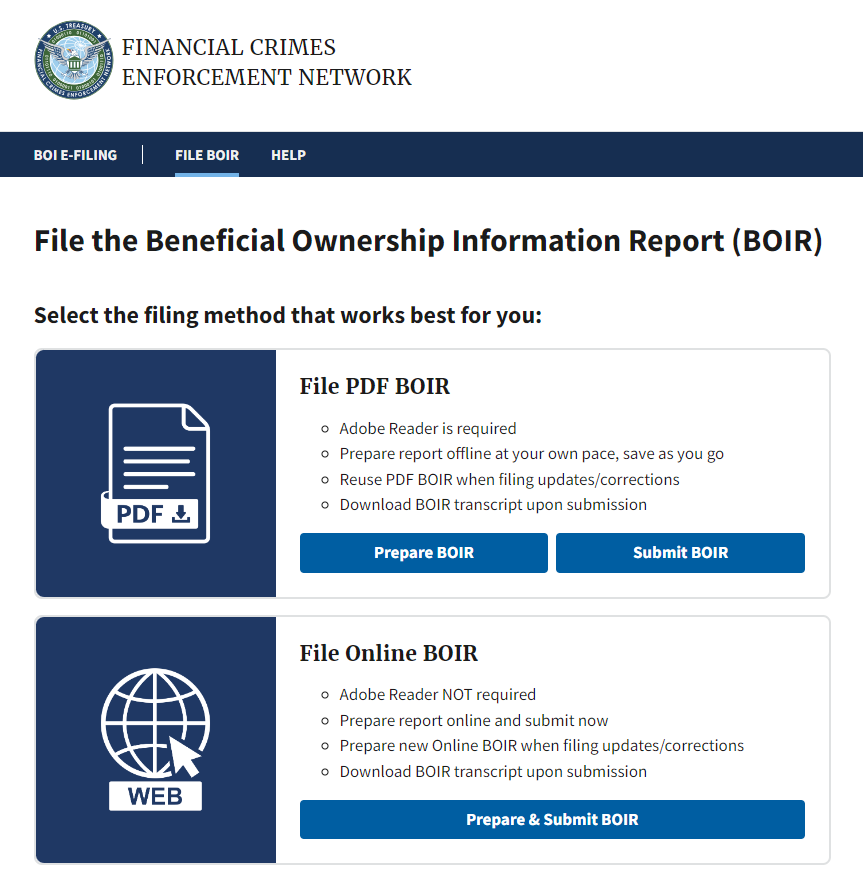

Visit this webpage: https://boiefiling.fincen.gov/fileboir

Click the "Prepare & Submit BOIR" button under "File Online BOIR"

Step 2

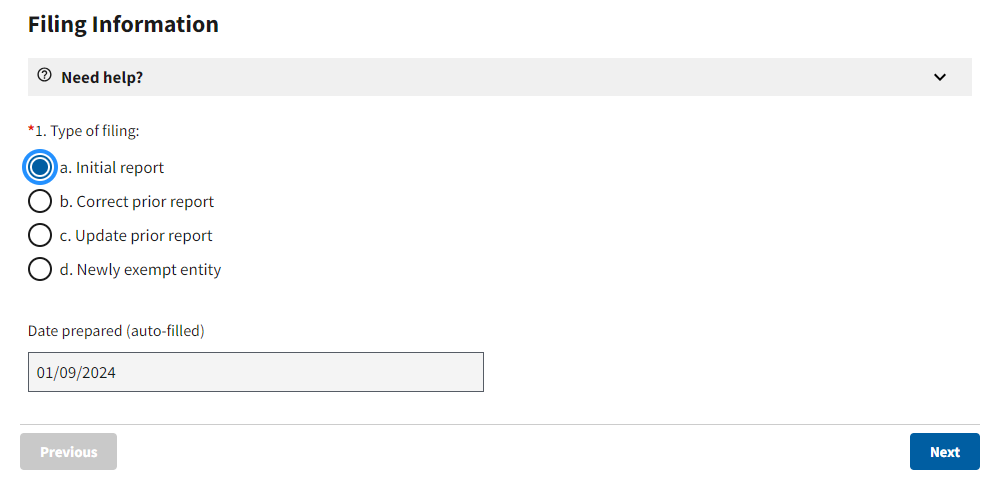

Select "Initial Report" for the first question, then click "Next"

Step 3

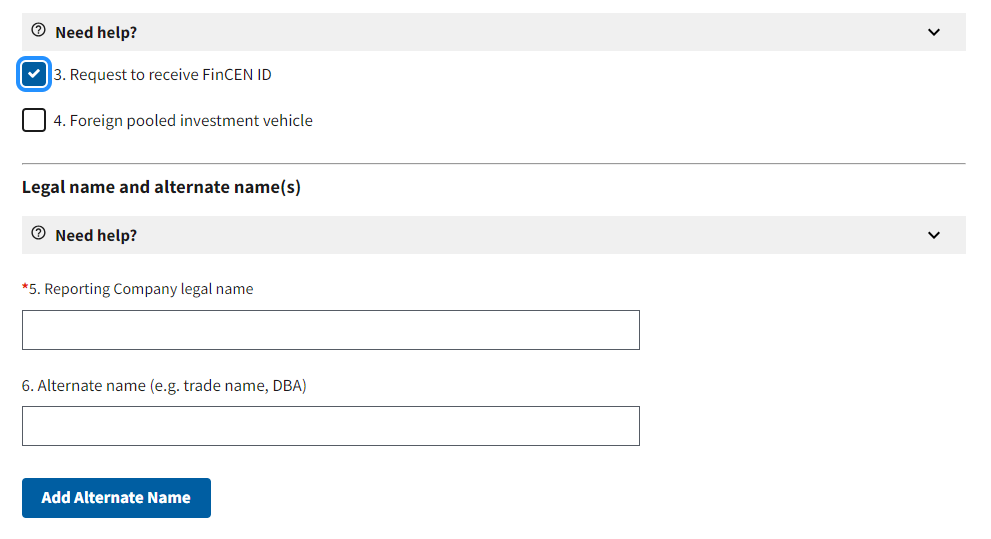

It's optional to select "Request to receive FinCEN ID" (you don't have to have one, but it may make future reporting and updating a report easier)

Under "Reporting Company legal name" enter full legal name of your business entity as recorded on the articles of incorporation or other documents you received when registering your business

If you also have a DBA ("doing business as") or other trade name for your entity, enter it under "Alternate name," otherwise, skip this question

Step 4

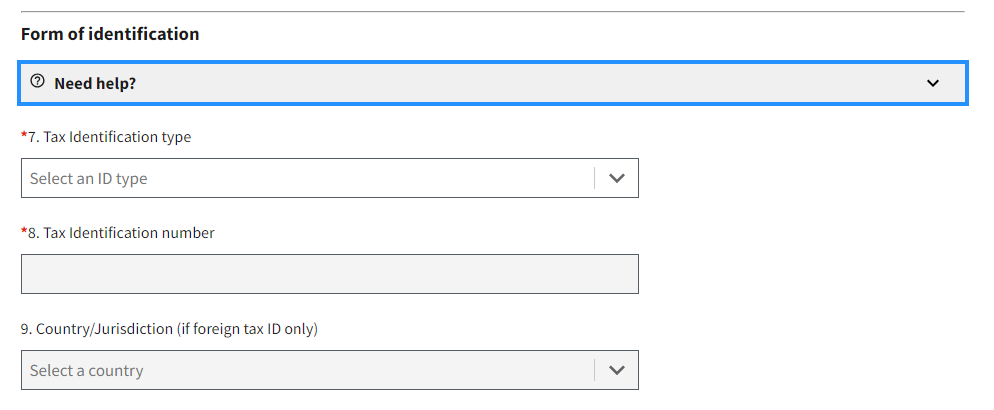

Under "Tax identification type" select the appropriate option for your entity (“EIN” is for Employer Identification Number; “SSN-ITIN” is if you use a Social Security Number or Individual Taxpayer Identification Number for your entity. These instructions are only for U.S. based entities, if you have a foreign-based business, seek out separate advice)

Single-member LLCs are generally disregarded entities and should select “SSN-ITIN"

Enter the EIN for the entity or the social security number for the single-member LLC owner

Step 5

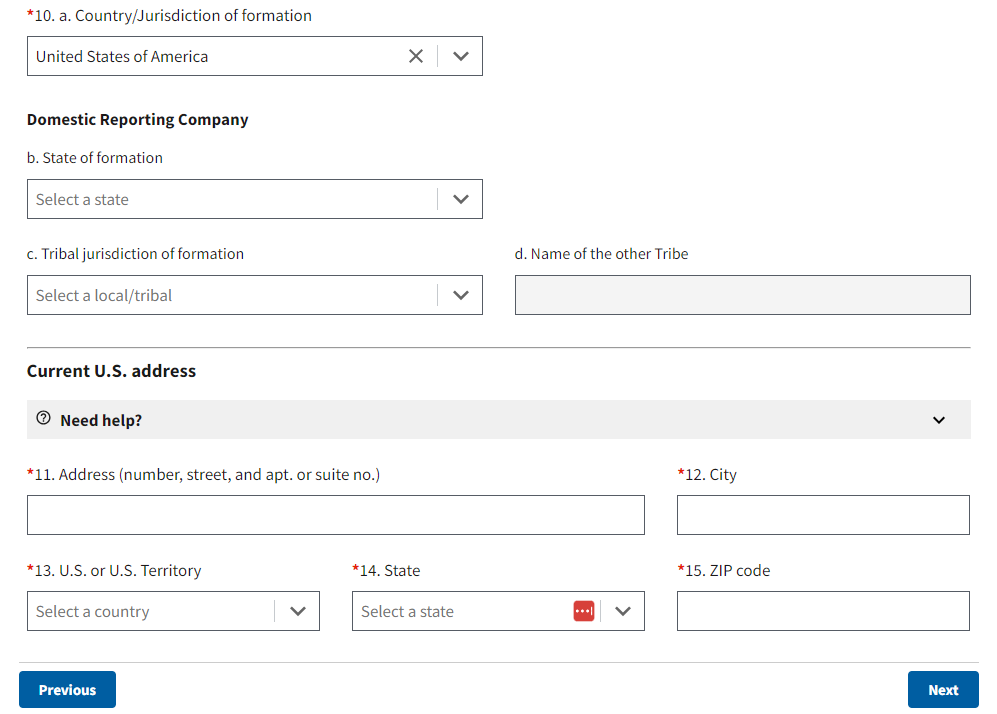

Under "Country/Jurisdiction of formation" select "United States of America"

Then fill out the state or tribal jurisdiction and address information

Click the "Next" button

Step 6

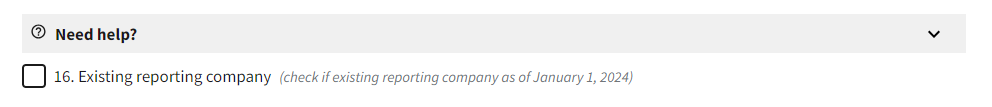

If your company was registered prior to January 1, 2024, check the box next to "Existing reporting company"

If you are filing this report for an entity registered on or after January 1, 2024, do not check the box next to "Existing reporting company"

Step 7

If you checked the box next to "Existing reporting company," you will skip "Part II. Company Applicant Information" and click "Next" at the bottom

If you did not check the box next to "Existing reporting company," fill out all of the required information in "Part II. Company Applicant Information"

Step 8

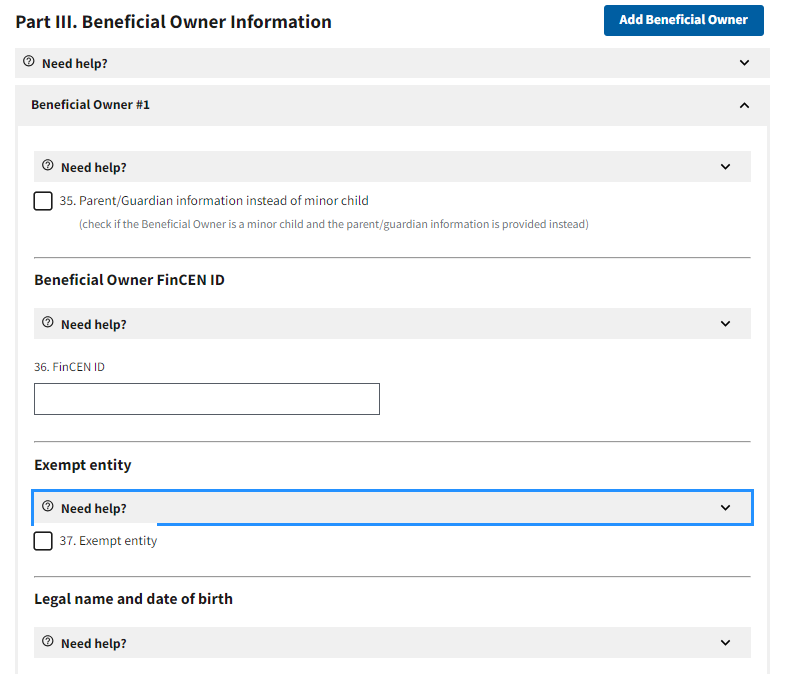

In "Part III. Beneficial Owner Information" you will need to fill out all of the required information for each beneficial owner (in this case, anyone who owns/controls at least 25% of the entity and/or exercises substantial control over the entity [more info])

For a single member LLC, there will generally only be one beneficial owner

Once you've entered all beneficial owners, click "Next"

Step 9

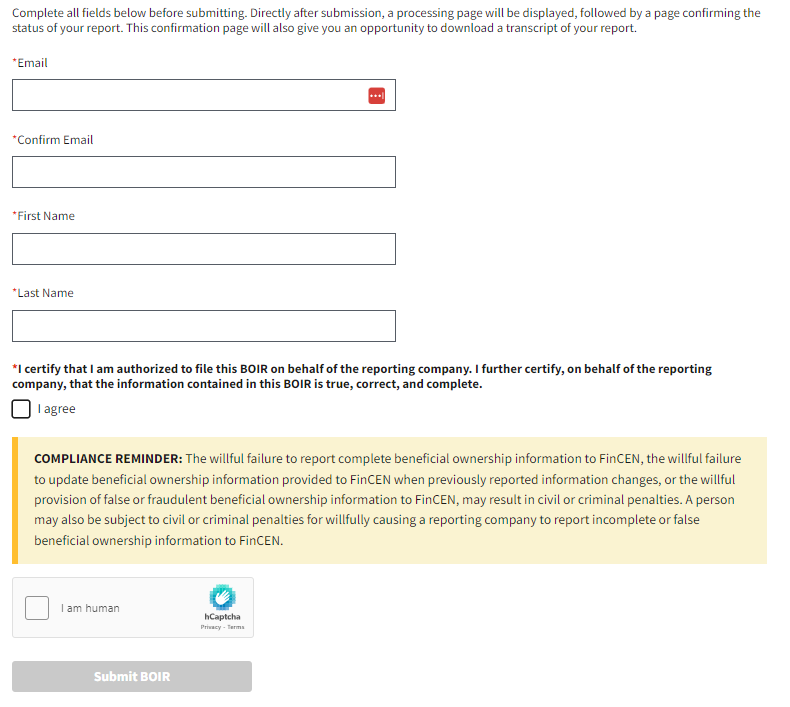

In the final step, enter an email address and the name of the person filling out the form, certify that you are authorized to file the report, and complete the Captcha (you may get one or more pop up windows)

Click "Submit BOIR"

Step 10

Print a copy of the "Submission Status Confirmation" page and click "Download Transcript," then save that print out and transcript for your records.

Again, the above instructions are general and only apply to people filing an initial report for a US-based business entity. If you have questions, have a unique situation, or need additional help, please get in touch.