Your Brass Taxes Account

How do I get started?

Ready to have us file your taxes? Here's what you need to do!

Last updated on 28 Oct, 2025

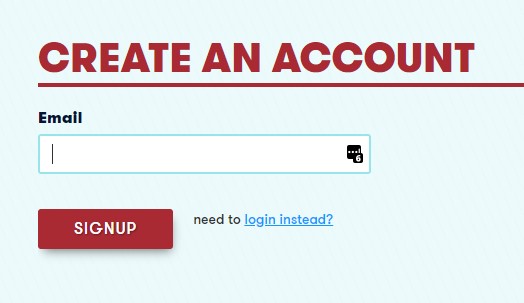

Step 1. Create an account on our website.

Step 2. Select the year and type of return you're filing. Personal returns are for freelancers, sole proprietors, and single-member LLCs. Business returns are for multi-member LLCs, partnerships, S-corps, and C-corps.

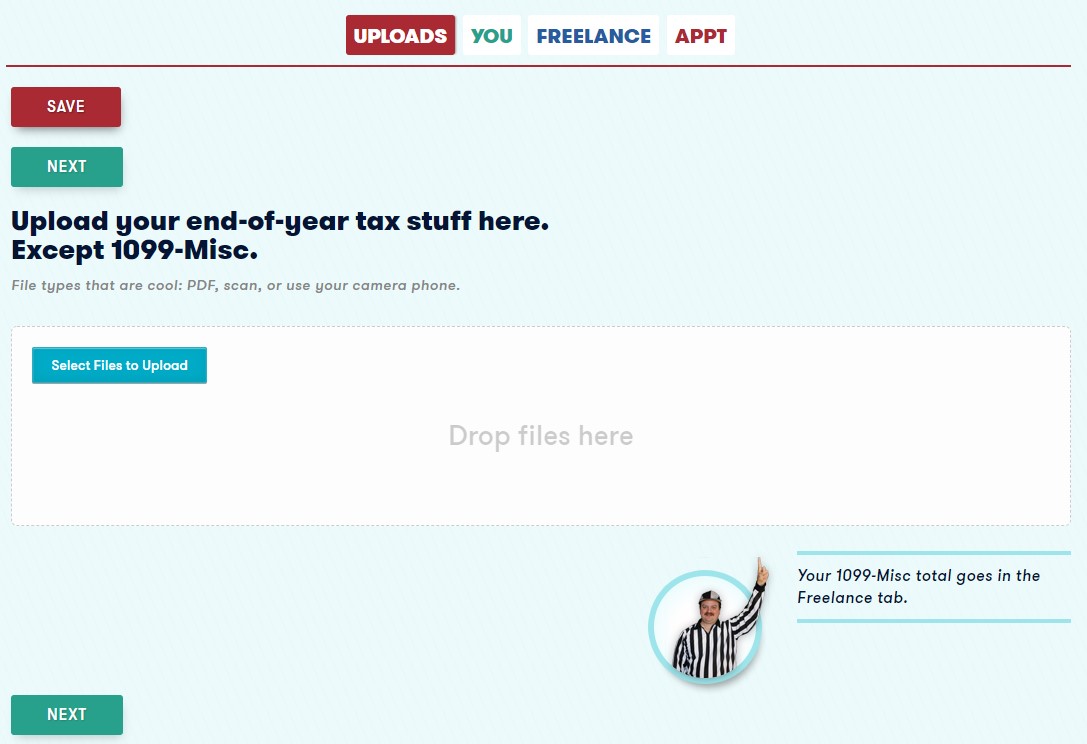

Step 3. Once you're in the tax return, upload your tax forms and enter your information. Not sure which forms to upload? Here's a list of what we need. Uploading your forms and filling out the website before you book an appointment helps us better help you.

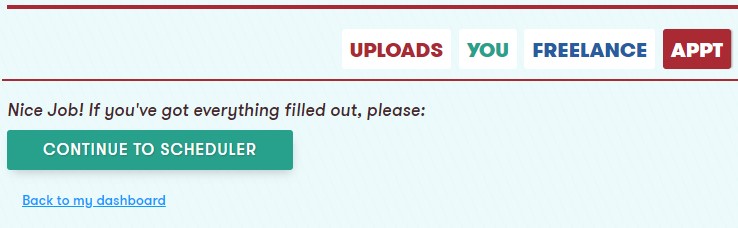

Step 4. Once you've uploaded your tax forms and filled out the website, you're ready to book an appointment. Click on the APPT tab, and CONTINUE TO SCHEDULER will take you to our online scheduler.

Appointment Types:

1hr Video Meeting: A one-hour video call with your tax preparer. This type of appointment is a great option if you have a lot of questions, need additional support, or just want to talk face-to-face.

Phone Call: Typically a 20-30 minute phone call with your tax preparer, who will give you a call during the one-hour window you selected when they're ready to go over your tax results. This option is best for folks who don't have a lot of questions and who are confident their uploaded information is complete. Phone call appointments are only available to returning clients.

Questions? Feel free to email us at info@brasstaxes.com.