Your Brass Taxes Account

Full Service Scheduling Instructions

Last updated on 29 Oct, 2025

All appointment scheduling is now completed through the Brass Taxes website. Access your account by logging into the website: www.BrassTaxes.com. Below are the instructions to book each appointment type.

BUSINESS TAX RETURN (S-corp & partnership)

Step 1: Log in to your Brass Taxes dashboard (www.BrassTaxes.com)

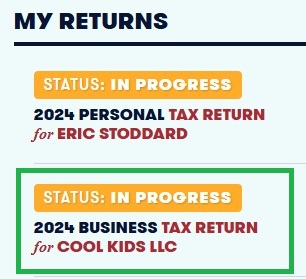

Step 2: Your business tax return has already been started for you. Find it in your list of tax returns (example shown below)

Step 3: We already have all of the information needed to complete this tax return through Quickbooks, so you do not need to complete any questions. We do need you to book your appointment here!

PERSONAL TAX RETURN (& sole proprietorships)

Step 1: Log in to your Brass Taxes dashboard (www.BrassTaxes.com)

Step 2: Your personal tax return has already been started for you. Find it in your list of tax returns (example shown below).

Step 3: Please complete the full questionnaire here before your tax appointment. We have everything from your business already (including K-1), but upload all other tax documents. You'll book an appointment here.

CONSULTATIONS

As part of the Full Service Program, you have access to 5 additional consultations annually at no cost. You'll book these through your dashboard:

Step 1: Login to your Brass Taxes dashboard (www.BrassTaxes.com)

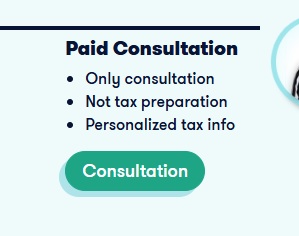

Step 2: Select CONSULTATION near the top of the page. Our system automatically tracks your included consultations, so there will be no cost to booking.

Note: Your remaining consultations available for the year are listed at the top of this next page.

Step 3: Click START NEW CONSULTATION, fill out your basic information, and click CONTINUE.

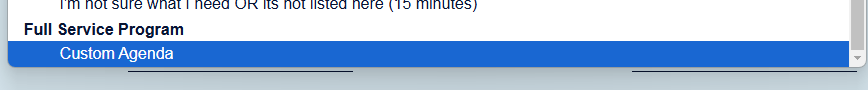

Step 4: Select a consultation topic from the list and submit. CUSTOM AGENDA gives you access to your dedicated tax advisor's reserved schedule.

During the tax season, our team availability is limited, so you'll need to select Custom Agenda.