Income & Expenses

How big is my home office?

If you have a home office used exclusively and regularly for your freelance business, it often represents a pretty big business expense, which can help a lot when it comes to your taxes.

Updated 2 weeks ago

Figuring out whether or not you've got a home office can help with your tax bill, but how do you go about calculating its size?

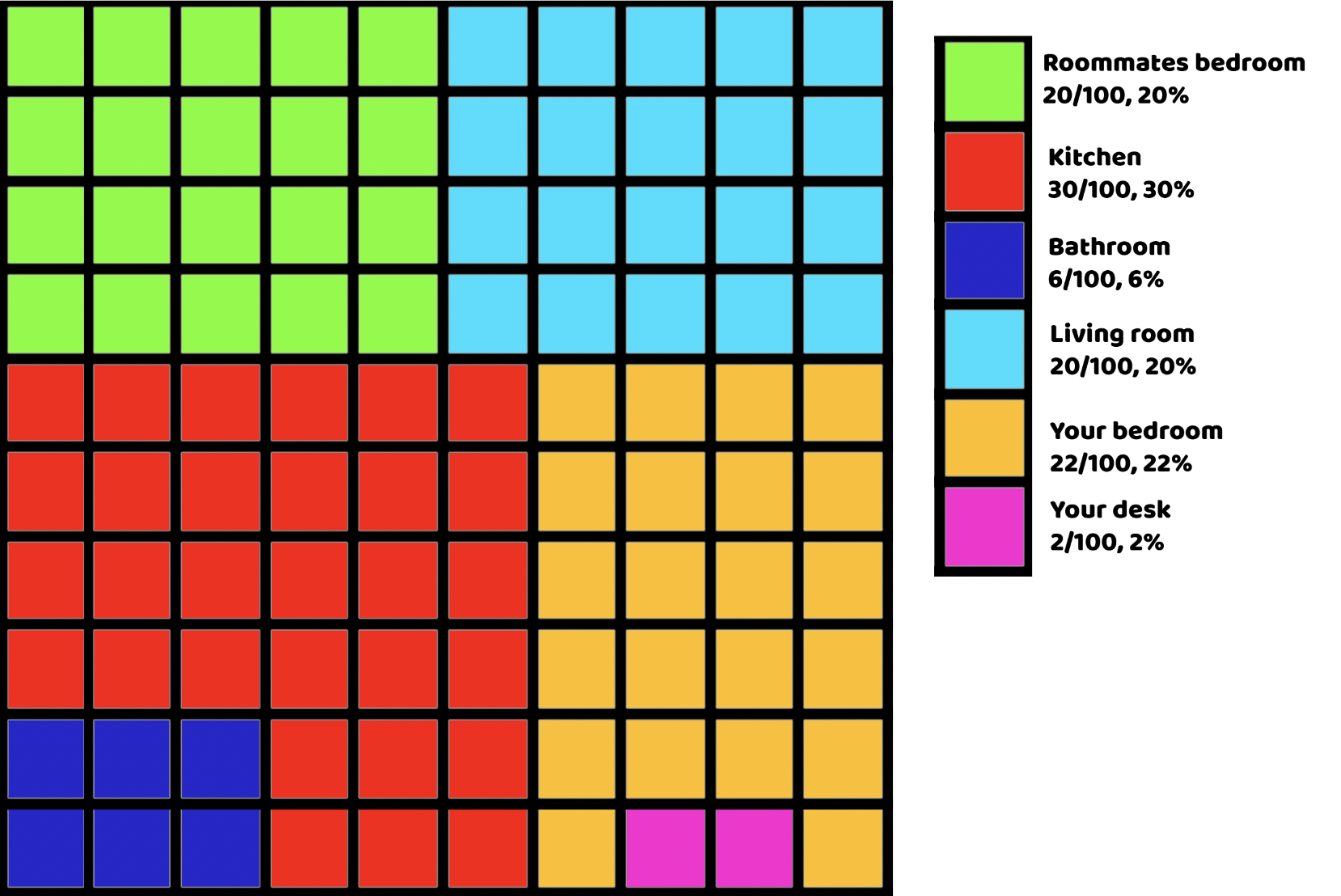

1. How big is the place where you live? Your home or apartment’s complete square footage is a great place to start. But you need to be sure to consider only the space you have access to and pay for. So, for example, if your apartment is 1,000 square feet, but your roommate has a bedroom and closet that take up 300 square feet, then you wouldn’t include that in your total. In that situation, your total would be 700 square feet.

2. How much do you use for your office? If you have a separate room used regularly and exclusively for freelancing, then this calculation is really easy: just take the approximate measurements of the room, and you’re all set. But don’t despair if you don’t have a separate room. You can definitely use part of a room. When you measure, include the space for your desk, chair, and any bookcases or furniture you used to store things for your business.

3. Enter your numbers on our website. Just do the best you can as you go through our website questions inputting basic information. Your tax preparer will double-check and confirm the size of your home office, so you will have a chance to talk through the specifics of your situation.

Ready to get your taxes started? Head over to BrassTaxes.com to upload your documents and make an appointment.