Additional Common Questions

How do I find my 1095-A tax form?

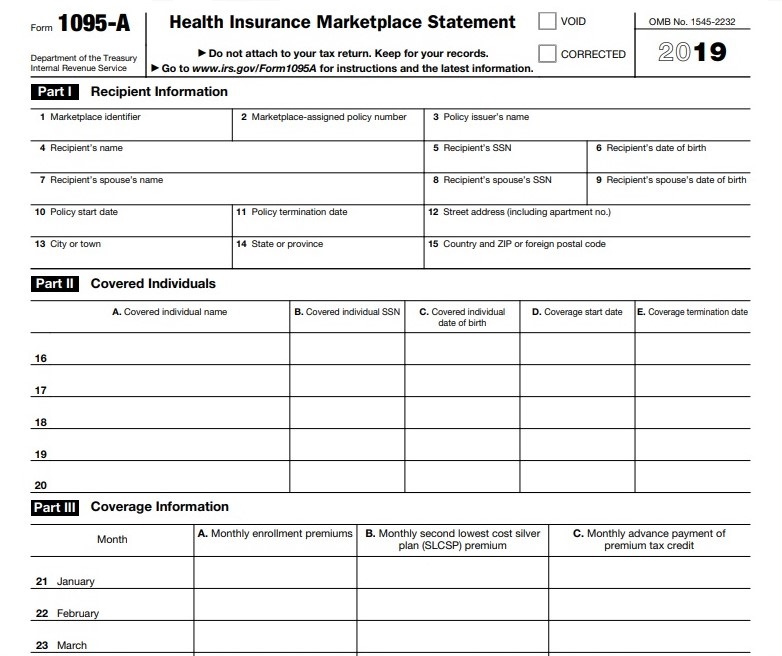

If you had “Obamacare” or marketplace health insurance from HealthCare.gov or a state exchange, we will have to have this form in order to file your taxes. Below are instructions for how to locate this form.

Updated 4 days ago

If anyone in your household had a Marketplace plan at any point during the year (even if it was just for a month), you should have gotten Form 1095-A (Health Insurance Marketplace Statement), by mail no later than mid-February. It is generally available on your HealthCare.gov account (or your state's website) as early as mid-January.

Under "Your Existing Applications," select the year for which you're doing taxes.

Select “Tax Forms” from the menu on the left.

Download the 1095-A shown on the screen.

Once you have the form, upload it while preparing to book your tax appointment, and we will be sure it is entered with your return.