Filing and Paying Your Taxes

Paying Estimated Quarterly Taxes

Confused about how and when to pay estimated quarterly taxes? We've got you covered.

Updated 1 week ago

What are estimated taxes?

When you work a W2 job, your employer generally withholds and pays taxes for you throughout the year. If you are self-employed or earn any untaxed income, you are responsible for doing that on your own by making quarterly estimated tax payments. You pay estimated quarterly taxes to both the IRS and the state that you live in.

Where do I pay them?

IRS: Pay online here

New York: Pay online here

California: Pay online here

Other states: search “pay [state] estimated taxes online” in Google, and click on the top .gov result.

How much do I pay?

Since these are estimated tax payments, there are a few ways you can determine how much to pay. There’s no wrong way to do it, and paying any amount will help reduce the burden when you file. Here are a few simple options:

Pay what you paid last year

You can use what you paid in taxes last year to estimate your federal quarterly payments by finding your total tax paid and dividing it by 4.

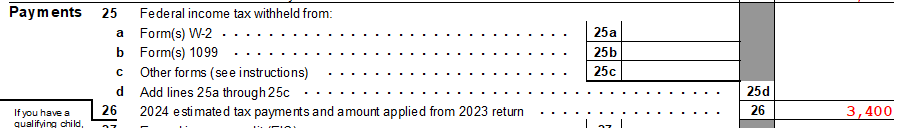

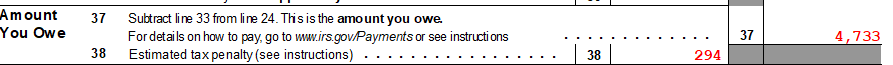

To find the total tax paid for the previous year, look at the form 1040 for your previous year tax return (the first two pages of the federal tax return). Add the amounts on line 26 and line 37. That's your total tax paid last year; divide that number by 4 to find the amounts of your quarterly payments for this year.

Example:

Line 26 = $3,400. Line 37 = $4,733.

$3,400 + $4,733 = $8,133

$8,133 / 4 = $2,033. This person would make four quarterly payments of $2,033 to the IRS.

Pay a percentage of your quarterly profit

When you are self-employed, you only have to pay taxes on your profit (income minus expenses). If you earned $20,000 in the first quarter of the year and had $5,000 in expenses, you’re left with $15,000 in profit. The amount of tax you owe on that $15,000 will depend on your total household income (like if you also have a W2 job) and what state you live in.

Each quarter, estimate your profit for that quarter and use that number to calculate your federal and state quarterly payments.

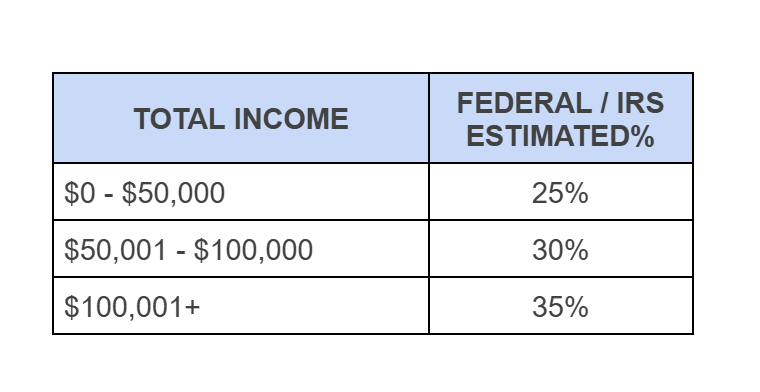

To calculate your federal estimate, use this table. Total income includes freelance income, W2 income, and all other sources of income, such as stocks and rentals. If you're married and filing jointly, you'll want to add your spouse's income as well.

The state percentage will depend on the state you live in. A safe estimate for most states is 5%. (New York City residents should use 8%).

Schedule a consultation

This is not an intuitive process, especially if you're doing it for the first time! If you’re completely lost and don’t know what to do, we can help during a one-time consultation. While we can’t set up payments on your behalf, we can walk you through generating an estimate for the IRS and your state.

When do I pay estimated taxes?

The dates for which estimated quarterly taxes are due are:

Q1 Deadline is April 15

Q2 Deadline is June 15

Q3 Deadline is September 15

Q4 Deadline is January 15 of the following year

* If the due date for making an estimated tax payment falls on a Saturday, Sunday, or legal holiday, the payment will be on time if you make it on the next day that's not a Saturday, Sunday, or legal holiday.

You can also check out our FAQ article on whether or not you should pay estimated taxes.